If you don’t know how to find your credit score, you’re in the right place! If you don’t know what a credit score is, check out this article for more information. You can also see our Education page for more helpful articles.

There are multiple ways to find your credit score, the easiest and most common to access your score is through your financial institution. If you bank with RBC, CIBC, BMO, or Scotiabank then the process is quite simple.

Scotiabank

Scotiabank makes it easy for users to find their scores. You can access it through the dashboard of your account underneath the “Additional Links” dropdown.

BMO

BMO allows users to take it one step further with their “CreditView” tool that provides not only your credit score, but also several other features and functions. Of these is an educational portion to help users find ways to improve their credit score, and a simulator to see how their score may be affected with the acquisition of a new credit item.

CIBC

If you bank with CIBC you can access your score through CIBC’s mobile app. It’s a convenient way to keep yourself updated on where you stand, but there are better options for more heavy users.

RBC

Lastly, RBC also makes finding your credit score quite easy. Similar to Scotiabank, it can be found on your account page, under a button labeled “View Your Credit Score”. And similar to BMO, RBC offers educational tools to help users improve and maintain their credit scores.

One thing to note with these banks is that credit scores are updated on a monthly basis, which for average credit card users is more than enough. However, if you’re a power user, you may consider using an alternative like the ones discussed below that offer weekly updates. Also, it’s all free!

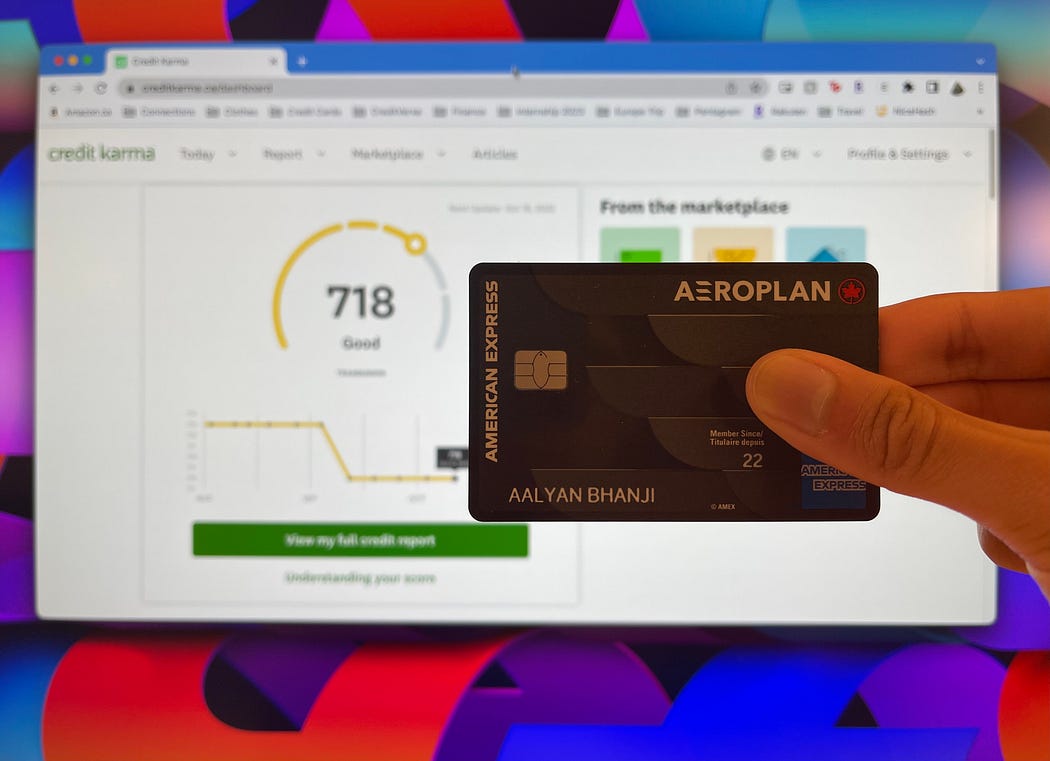

If you bank with someone else like TD, then you have to explore alternative methods. Don’t worry, it’s still simple to find and monitor your score. The scores are provided and calculated by either TransUnion or Equifax, and accessible through third-party services. There are many easy to use and safe services that offer credit score tracking. Some notable ones in Canada are Borrowell (Equifax) and Credit Karma (TransUnion). You can also access your scores directly from the credit agencies by mail or telephone, however the process involves much more work.

We hope this article helped, and be sure to check out our other resources so you can better understand your finances!

Leave a Reply